All Categories

Featured

Table of Contents

[/image][=video]

[/video]

Roth 401(k) payments are made with after-tax payments and afterwards can be accessed (profits and all) tax-free in retirement. Dividends and resources gains are not strained in a 401(k) strategy. Which item is best? This is not an either-or decision as the items are not substitutes. 401(k) strategies are created to assist staff members and entrepreneur develop retired life financial savings with tax obligation benefits plus receive potential company matching payments (free added cash).

IUL or term life insurance policy may be a requirement if you wish to pass cash to successors and do not believe your retired life financial savings will certainly meet the goals you have actually specified. This material is planned just as basic details for your benefit and must not in any type of method be interpreted as financial investment or tax obligation suggestions by ShareBuilder 401k.

Dave Ramsey On Iul

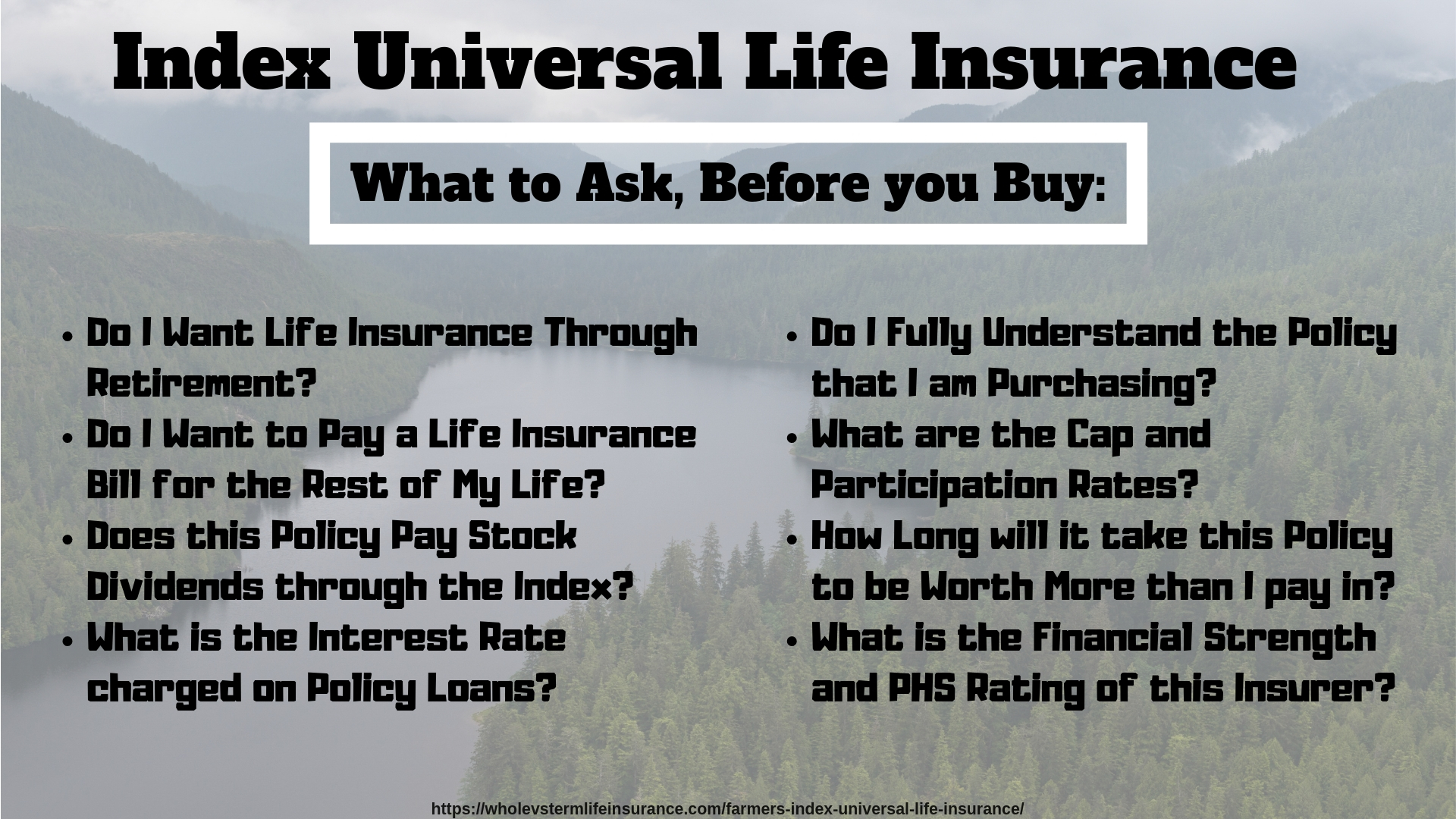

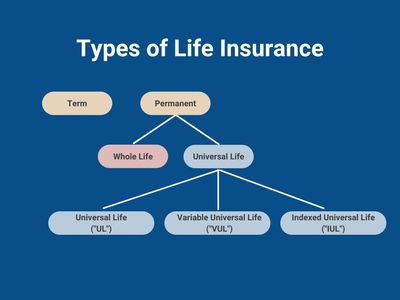

Your financial circumstance is distinct, so it is essential to locate a life insurance coverage product that satisfies your certain needs. If you're looking for life time insurance coverage, indexed universal life insurance coverage is one alternative you may intend to consider. Like other long-term life insurance policy items, these policies permit you to develop cash value you can touch throughout your lifetime.

That implies you have more long-term development capacity than an entire life policy, which uses a fixed rate of return. Yet you likewise experience a lot more volatility considering that your returns aren't ensured. Generally, IUL policies stop you from experiencing losses in years when the index declines. Nevertheless, they additionally top your passion credit scores when the index rises.

Nevertheless, understand the advantages and drawbacks of this item to identify whether it lines up with your economic goals. As long as you pay the premiums, the policy stays active for your entire life. You can accumulate cash worth you can use during your life time for different economic demands. You can readjust your costs and survivor benefit if your scenarios transform.

Irreversible life insurance policy policies usually have greater first costs than term insurance policy, so it may not be the appropriate option if you get on a limited budget. The cap on interest debts can limit the upside capacity in years when the securities market performs well. Your policy might gap if you obtain too big of a withdrawal or policy lending.

With the possibility for even more durable returns and adjustable payments, indexed universal life insurance policy might be an alternative you desire to consider., who can examine your personal circumstance and provide tailored insight.

Indexed Universal Life Insurance: Benefits & Risks

The information and summaries contained here are not intended to be total summaries of all terms, problems and exclusions relevant to the items and solutions. The specific insurance protection under any nation Investors insurance product is subject to the terms, conditions and exclusions in the real policies as issued. Products and solutions described in this site differ from state to state and not all items, coverages or services are offered in all states.

If your IUL plan has adequate cash money value, you can obtain against it with adaptable payment terms and reduced rates of interest. The option to design an IUL plan that reflects your certain needs and circumstance. With an indexed universal life plan, you designate premium to an Indexed Account, thus creating a Segment and the 12-month Segment Term for that section starts.

Withdrawals may occur. At the end of the sector term, each section gains an Indexed Credit. The Indexed Credit score is computed from the adjustment of the S&P 500 * during that a person- year period and is subject to the restrictions proclaimed for that segment. An Indexed Credit history is calculated for a section if value remains in the segment at sector maturity.

These limitations are established at the beginning of the section term and are assured for the entire section term. There are four options of Indexed Accounts (Indexed Account A, B, C, and E) and each has a various kind of limit. Indexed Account A sets a cap on the Indexed Credit score for a segment.

The development cap will differ and be reset at the start of a section term. The involvement rate identifies just how much of a rise in the S&P 500's * Index Worth uses to sections in Indexed Account B. Higher minimal growth cap than Indexed Account A and an Indexed Account Cost.

Indexed Universal Life Express Mutual Of Omaha

There is an Indexed Account Charge associated with the Indexed Account Multiplier. No matter of which Indexed Account you select, your money value is constantly shielded from unfavorable market performance.

At Sector Maturation an Indexed Credit is computed from the modification in the S&P 500 *. The worth in the Segment gains an Indexed Credit which is determined from an Index Growth Price. That development rate is a percent change in the current index from the start of a Sector till the Section Maturation date.

Sectors immediately restore for another Sector Term unless a transfer is asked for. Costs got because the last sweep date and any type of asked for transfers are rolled into the very same Segment to make sure that for any type of month, there will be a solitary brand-new Section produced for a provided Indexed Account.

Index Universal Life Insurance Explained

You might not have actually believed much about how you desire to invest your retirement years, though you possibly recognize that you do not desire to run out of cash and you 'd like to preserve your existing way of life. [video: Text appears next to the business man speaking to the camera that reads "company pension", "social security" and "savings".] In the past, individuals depended on 3 main sources of earnings in their retirement: a business pension, Social Protection and whatever they 'd handled to conserve.

And lots of companies have decreased or ceased their retired life plans. Even if advantages haven't been lowered by the time you retire, Social Safety and security alone was never ever meant to be sufficient to pay for the way of life you want and are entitled to.

Iscte Iul

While IUL insurance policy may confirm useful to some, it's important to comprehend exactly how it functions prior to acquiring a policy. Indexed universal life (IUL) insurance coverage plans offer higher upside potential, adaptability, and tax-free gains.

As the index moves up or down, so does the price of return on the cash money worth element of your policy. The insurance policy company that provides the policy might offer a minimal surefire rate of return.

Economists typically advise living insurance policy protection that amounts 10 to 15 times your annual income. There are numerous drawbacks linked with IUL insurance plan that doubters are quick to explain. Someone who establishes the policy over a time when the market is executing improperly might finish up with high costs repayments that don't contribute at all to the money value.

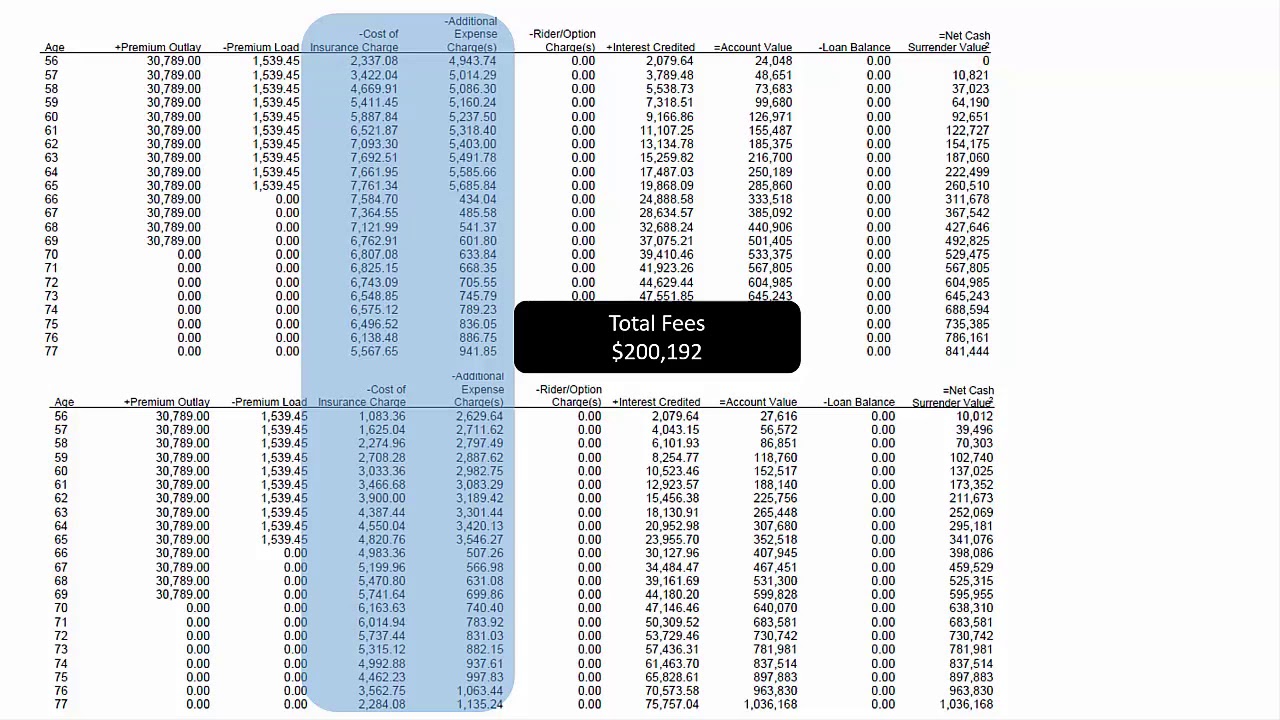

Besides that, remember the following various other factors to consider: Insurance policy business can establish involvement rates for just how much of the index return you obtain each year. Allow's claim the plan has a 70% engagement price. If the index expands by 10%, your cash money worth return would certainly be just 7% (10% x 70%).

Furthermore, returns on equity indexes are often topped at an optimum quantity. A policy may state your maximum return is 10% annually, no issue how well the index does. These limitations can restrict the real rate of return that's attributed towards your account yearly, no matter exactly how well the policy's hidden index does.

It's vital to consider your individual danger resistance and investment objectives to guarantee that either one lines up with your total strategy. Whole life insurance policy policies usually include a guaranteed interest rate with predictable exceptional amounts throughout the life of the plan. IUL plans, on the various other hand, offer returns based upon an index and have variable premiums in time.

Latest Posts

Panet Co Iul

Is An Iul A Good Investment

Full Disclosure Indexed Universal Life Report